In 2025, the cost of owning an electric vehicle (EV) goes far beyond just the sticker price. When comparing EVs to traditional internal combustion engine (ICE) vehicles, many people focus on the upfront cost. However, long-term savings, lower maintenance, fuel savings, and government incentives can make EVs significantly more affordable over time. Let’s dive into the different elements that contribute to the total cost of ownership (TCO) of an EV and see how it stacks up against gasoline-powered cars.

Upfront Cost vs. Long-Term Savings

Electric vehicles have historically been seen as more expensive at the time of purchase. For example, a 2025 Tesla Model Y starts at around $44,000, while a comparable gasoline SUV might start at $35,000. That difference often causes hesitation among first-time buyers. However, when factoring in long-term savings from fuel, maintenance, and tax incentives, EVs often come out ahead.

Most EV owners save significantly on fuel because electricity is cheaper than gasoline in nearly all U.S. states. According to the U.S. Department of Energy, driving an EV typically costs the equivalent of paying $1.41 per gallon of gas. In addition, EVs have fewer moving parts, there’s no engine oil to change, no transmission fluid, and far fewer mechanical failures over time. As a result, EVs have been shown to save thousands of dollars in maintenance and repairs over their lifetime.

Federal and State Incentives: What’s Available in 2025

Thanks to the Inflation Reduction Act (IRA) and growing state-level support, buying an EV in 2025 is more financially attractive than ever. Under the Federal EV Tax Credit, buyers can get up to $7,500 in credits when purchasing a new qualifying electric vehicle. This is claimed using IRS Form 8936 and applies to many U.S.-assembled models with battery components sourced from approved countries.

State programs sweeten the deal even more. For instance:

- California’s Clean Vehicle Rebate Project (CVRP) offers up to $2,000 more for eligible low- and middle-income residents.

- New York’s Drive Clean Rebate offers up to $2,000 off the purchase of a new EV.

- Colorado, Oregon, and New Jersey also have active rebate or sales tax exemption programs.

All these incentives can dramatically reduce the Manufacturer’s Suggested Retail Price (MSRP), often bringing a $40,000 EV down to the mid-$30,000s, or less.

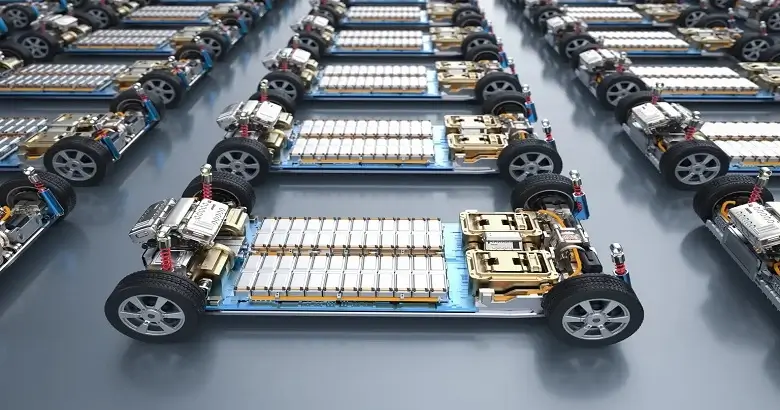

Maintenance and Repairs: EVs Cost Less Over Time

When it comes to ongoing maintenance, EVs are hard to beat. Unlike traditional vehicles, they don’t have oil filters, timing belts, or spark plugs. With fewer moving parts and regenerative braking systems that reduce wear on brake pads, EVs require fewer trips to the mechanic.

According to Edmunds and Kelley Blue Book, EVs cost about 30%–50% less to maintain over a 5-year period compared to ICE vehicles. Common EV maintenance costs include:

- Tire rotation and replacement

- Cabin air filter changes

- Occasional battery coolant service (in some models)

The most expensive EV component is the battery pack, but modern batteries, like those from Panasonic, CATL, and LG Energy Solution, are built to last 8–15 years or more. They are also covered under long-term warranties (usually 8 years/100,000 miles), offering peace of mind.

Insurance Costs: Slightly Higher, But Closing the Gap

One area where EVs can cost more is auto insurance. In 2025, EV insurance premiums remain slightly higher than those for gasoline vehicles. This is due to:

- Higher vehicle value

- Specialized parts (like battery systems or sensors)

- Fewer available repair shops with EV expertise

However, this gap is closing as more insurers adjust pricing to reflect the growing EV market. The Insurance Institute for Highway Safety (IIHS) reports that EVs tend to perform well in crash tests and are less likely to roll over, which helps reduce certain risk factors. Some insurers now even offer EV-specific discounts or reduced premiums for using eco-friendly vehicles.

Fuel Savings: Electricity vs. Gasoline

One of the biggest financial benefits of EV ownership is in fuel savings. In 2025, gas prices remain unpredictable, averaging around $3.50–$4.00 per gallon. In contrast, charging an EV at home typically costs the equivalent of $1–$1.50 per gallon, depending on your local electricity rates.

- Charging a Tesla Model 3 at home costs roughly $10–$14 for a full charge, giving around 250–300 miles of range.

- Driving a gas car the same distance might cost $25–$30 in fuel.

That adds up over time. Over five years, EV owners can save $3,000–$5,000 or more just on fuel.

Tax Benefits, Depreciation, and Resale Value

While federal and state tax credits are a clear benefit, EVs in 2025 are also seeing stronger resale value than in the past. This is thanks to improvements in battery longevity, better public perception, and a more robust used EV market.

Cars like the Ford Mustang Mach-E, Hyundai Ioniq 5, and Tesla Model Y retain a significant portion of their value after three years, especially when battery health is maintained and mileage remains low.

Also, businesses and self-employed individuals can write off certain EV purchases under IRS Section 179, making them a smart investment for fleets and professionals.